Will Your Side Hustle Buy You A House This Year

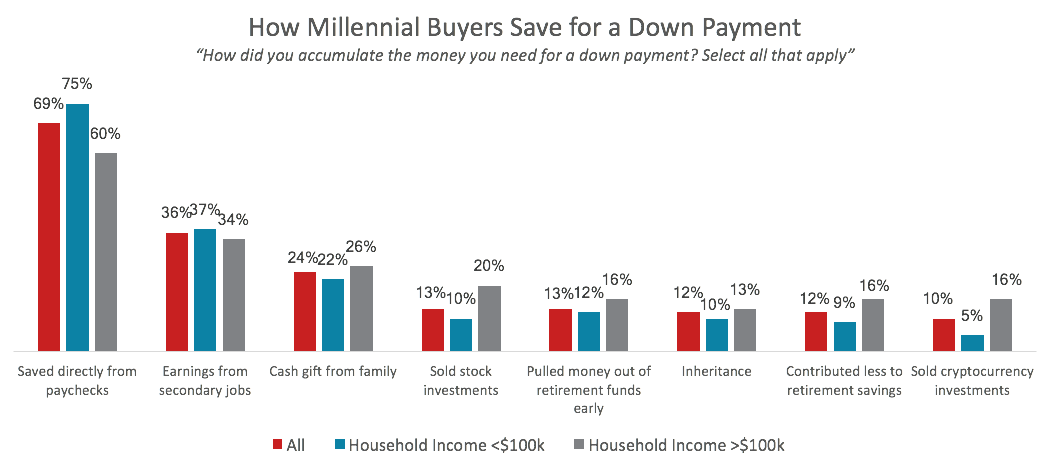

There are many different approaches to saving up to purchase a home, but were you aware that most Millennials (69% according to Redfin) saved directly from their paychecks. The remaining 31% percent of Millennials saved in a variety of ways, including picking up a second job, taking money from their 401K early, or selling cryptocurrency.

To some, this is a crazy statistic. The remaining question is, will having a "Side Hustle" allow you to save up for a down payment on a home?

We're here to help break that down for you.

Among the above, 3 Unique Sources of Meeting their Goal

Many Millennials don't save at all, but the ones that are interested in purchasing a home in 2019 are. They are doing so in a variety of ways.

The graph above breaks down the main sources of saving by Millennials.

1. Selling Stock

This is a big one for Millennials. They usually don't hold a lot of stock and if they do it's only been for a short period of time. So, in fact, if you did have some stock and were able to make some money on it you could be among the 20% of households that were making less than $100,000 to save up for a down payment.

2. Selling Cryptocurrency

With the majority of people being fairly new to the idea of Cryptocurrency, it's a unique way to approach saving up for a downpayment on a home. 16% of Millennials were selling Cryptocurrency to come up with the necessary funds or at least begin the saving process.

3. Uber

Lyft and Uber have been huge game changers for how people get around town, but I bet you didn't expect it was a source of income for people saving for a home. 15% of people saving for a home, according to a Redfin study are using this method!

So, is it possible?

The ability to sell stock, cryptocurrency, or drive for a car service is easier than ever nowadays. You can do it all pretty much from an app on your phone. So the answer is YES. If you take the necessary steps and want to purchase a home in 2019, just know there are plenty of ways to do so. But concerns can delay this endeavor. Many first time home buyers just need to be educated about the process and that's where we are here to help!

Ready to learn more about Homebuying?

Our team is ready to help.